5 Tips on How to Manage Money for New E-Commerce Entrepreneurs

If you are just starting out on your e-commerce business, it makes sense to keep a watchful eye on your budget. But for many new entrepreneurs, starting and getting business off the ground is more than just the business’ cash flow: at this stage, many entrepreneurs feel vulnerable for their finances, and it’s especially true […]

5 Truths About Starting an E-Commerce Business That New E-Commerce Entrepreneurs Should Know

Starting an e-commerce business can be a very exciting adventure for some. If you’ve always dreamed of starting a business but you’re intimidated by the startup costs and other complexities of starting a brick-and-mortar business, e-commerce and digital business can be a great way for you to get started! However, starting and running an e-commerce […]

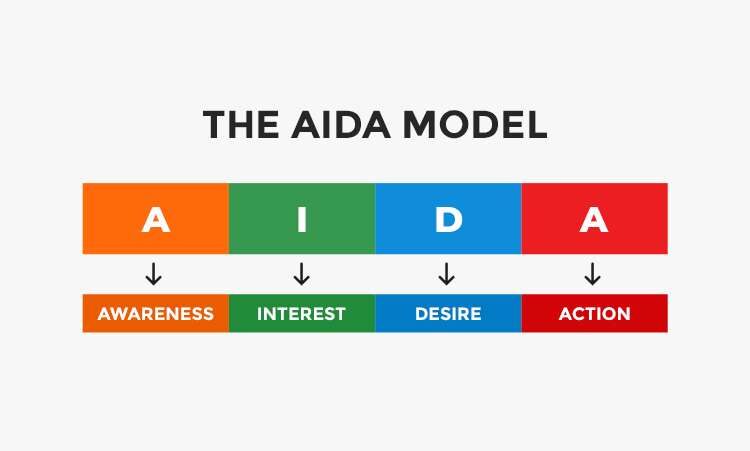

How to Apply the AIDA Model to Your E-Commerce Business

The AIDA model is a simple but effective model in leading your customers to buy your products. If you don’t know what AIDA is, read more to know what the AIDA model is and how you can apply it to your business. What is AIDA? The AIDA model is a marketing and advertising model that […]

EU ended VAT exemptions in July 2021 and implement IOSS

If you are either an EU or non-EU seller that sells within the EU region, take note of the following changes starting July 01, 2021. Starting July 01, 2021, all EU VAT-free goods – goods that are valued at EUR 22 or below – will now be charged with VAT. This means that all products […]

4 Reasons Why E-Commerce Sales Should Run on Different Channels

Are you running your e-commerce business via Amazon only? Have you set up shop on Shopify but did not set up shop elsewhere? If you are running your business on one sales channel only, you may want to consider running it on two – and then three, four and more sales channels! After all – […]

4 Reasons Why You Should Add a Blog on Your E-Commerce Store

Check any e-commerce store and you’ll mostly see a blog within it. Unlike back in the old days where blogs are separate from e-commerce store or retail websites, most e-commerce stores today have a blog in them regardless of their niche – fashion, toys, supplements, gadgets; you name it! If your store does not have […]

RBL Safeline News: RBL Safeline Had Its Soft Opening On Its New Branch at Keqiao

Dear customers and readers, If you are working with RBL Safeline, we are pleased to announced that RBL Safeline had its soft opening on its new branch at Keqiao Distrcit, Shaoxing City! RBL Safeline specializes in the Indian market, but it grew to expand into Bangladesh, Pakistan and Middle Eastern markets as well! Aslo, RBL […]

Fulfillmen News: Fulfillmen Celebrated Its 4th Anniversary!

Dear valued customers and readers, We are happy to announce that Fulfillmen just celebrated its (ordinal year) anniversary last May 2, 2020! Over the course of these years, Fulfillmen faced nuremous challenges – from hiring the best people and partnering with local courier lines to dealing with varying customs regulations of different countries. But all […]

Shipping News: Turkey to Enforce Nationwide Lockdown from April 29 to May 17

Due to increasing COVID-19 cases in Turkey, the Turkish government decided to put the nation into a nationwide lockdown. The said lockdown will run from April 29 to May 17. During this lockdown period, the Turkish government will allow for special delivery services, which means that our shipping arrangement is still normal. However, due to […]

Holiday News: Fulfillmen is Temporary Closed In Observance of The 2021 Labor Day

In observance of this year’s Labor Day, Fulfillmen is temporarily close its operations. We will be closed for 3 days, starting from May 1 to May 3. Normal company operation will resume on May 4. If you have any concerns about the holiday such as shipping or logistics concern, please let us know right away […]