After Shopify laid off 1,000 employees, the Internet raised concerns about stand-alone stations and DTC.

DTC and boutique stations are slowly displacing station groups as the industry’s mainstream, which is an undeniable trend.

This comprises station group vendors who have converted and upgraded, as well as newcomers who received DTC hot money.

But we also not only questioned: ” The concept of DTC has been popular for so many years, why can’t we find a third DTC brand that can be compared with SHEIN and Anker?”

They all say, “I have never eaten pork, and I have seen pigs run”.

For the independent station industry, aside from the “pig” that has gone thousands of kilometers.

It appears impossible to find a “new pig” that can understand its development prospects clearly and learn from the underlying economic logic.

So much so that the most sensitive capital markets have begun to be cautious about investing in DTC.

Why is it difficult for site group sellers to transform into DTC?

Due to PayPal and Shopify’s frequent account bans and after-financing “coercion” by the capital market.

Site group sellers who used to rapidly fission through the amoeba model have cut down a large number of site groups in the past two years, trying to transform DTC, Boutique station.

Those vendors who have switched from station groups to DTC and boutique stations are “alive” at their finest. I can’t say there are none “living well,” but there are few.

Why does this happen?

This supports the “genetic determination” hypothesis: station group sellers with operational model are hard to convert to DTC.

People, energy, and financial resources must be swiftly focused on one or two significant sites.

This is not a simple theoretical arrangement, any change will bring about a huge chain reaction.

First of all, the supply chain system needs to be rebuilt, and the team needs to be changed.

Most of the sellers in the previous station group did not have their own independent supply chain. Their transformation requires not only the establishment of a new supply chain system, but also a new team to adapt.

Second, the logic of advertising needs to be subverted.

Under the previous method of washing goods, group merchants tested large batches of goods and promoted the best test product.

The essence is to eat traffic dividends, which is also difficult in a short period of time. get rid of.

The disorderly product matrix hinders the brand’s overall image.

Third, decision makers and teams need to overcome a huge psychological gap.

Under the station group distribution model, 3 billion or 4 billion shares can be produced in a year.

DTC needs more time and energy and may only generate 100 million or 200 million shares, frustrating decision makers.

Even from the perspective of employees, the rapid shrinkage of commission income is unacceptable.

The fourth point is the integration of decision makers with new teams and talents and the establishment of trust.

Station group bosses’ inertia may cause a gap between their expectations for boutique stations and DTCs and the results of expert managers or dealers.

If the supervisor doesn’t comprehend DTC reasoning, he doesn’t recognize abilities and it’s hard to estimate their genuine capacity.

“These station group sellers may attain billions of volumes not because of their operational skills or product selection, but because of their large-scale, cheap labor.

It’s fundamentally uncompetitive. As a DTC or boutique site, it may not have the company’s basic organizational skills.”

Why are there few excellent DTC brands in China?

Casper, a US-born DTC mattress brand, is currently one of the largest in the American mattress market.

Casper circumvented typical mattress bulk transportation by putting the mattress in a tiny refrigerator-sized box.

This packaging method greatly saves storage space and transportation costs. The mattress returns to its usual size within a minute of being opened.

This revolutionary concept gives consumers a fresh experience and allows them to spread spontaneously on social media, which boosts sales.

Casper has a whole set of innovative marketing strategies, including free consumer distribution and 100-day free trial sleep services.

This kind of marketing greatly reduces the risk threshold of consumer psychology and improves the conversion of consumer orders.

Whether it’s packaging or marketing, several mattress brands have imitated Casper.

If a DTC brand has novel modes and gameplay like Casper, it will often grab market attention.

Correcting some weaknesses of the product, such a DTC brand has a high probability of being successful.

So why is it difficult to hatch such a benchmark DTC brand in China ?

To meet users’ psychological expectations, a brand must understand its target users and markets.

Such a result requires long-term brand study and development, and it must repeatedly try to understand user wants and psychology.

Compared with long-term heavy investments in “unpredictable” industries, the input and output are higher for most domestic firms, and the risk is smaller.

The result may not be too bad for the company’s books. But breaking over the industry ceiling, breaking users’ and the market’s perception, and developing a DTC brand similar to Casper has lost its base.

Take ad serving as an example:

Most independent websites utilize the same ads to target different channels and segments.

Ultimately, whichever content converts the most will be expanded and other ads with bad conversions will be shut off.

There is basically no product analysis, no customer analysis, and no targeted advertising materials.

Amazon’s altered sellers refer to Amazon’s TOP list of products – which of the top 100 sell well – and create the same thing at a reduced cost.

Sell at a low price .

Before publishing an ad, a website or Amazon seller should assess the product’s intended client demographic.

- what kind of selling point and information should be highlighted for the high-end crowd ?

- What kind of selling points and benefits do you need to show for middle-class users ?

Of course, different categories have different difficulty in understanding users.

Localize, investigate, and subdivide hundreds of thousands of SKUs for fast fashion categories.

Like some 3C accessories, additional interactivity can be based on the accessory host brand’s user portrait.

For example, camera accessory development is based on what buyers want.

The most important of these is the specific and precise interaction between the brand and the user.

In the prior market research on the new product, interactions with users established the product’s development orientation. Even with users doing commissions and fission, there is a complete user application system.

On the other hand, based on the seller’s market, study the selling points and user portraits of the camera itself, and develop targeted accessories. The core goal is to amplify the main selling point of the camera itself.

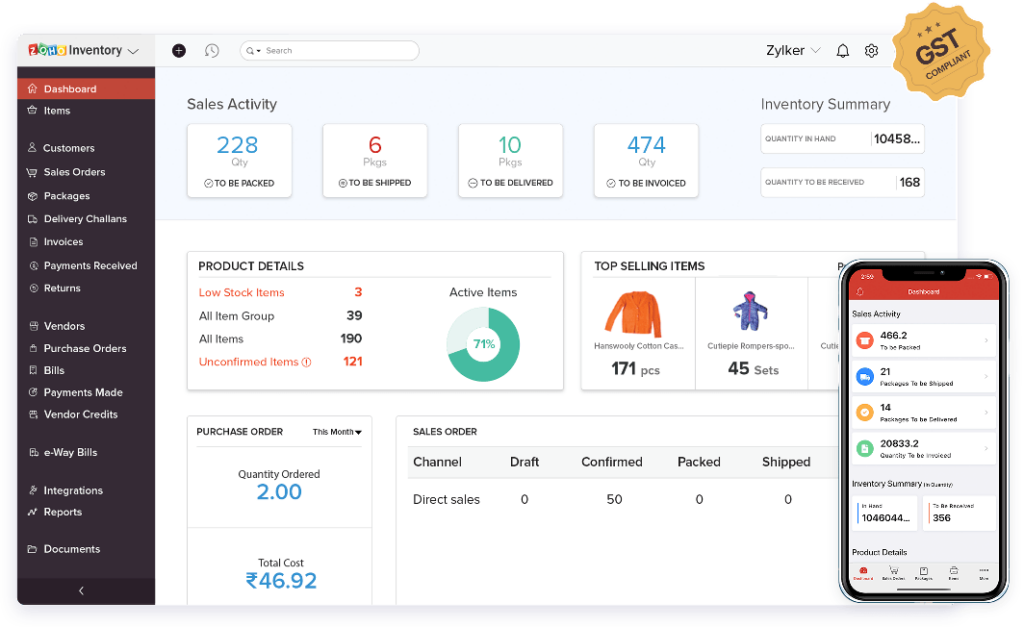

How much investment does it take to do DTC ?

If you sell furniture, you’ll need a lot of capital for goods, logistics, warehousing, and other charges.

And for some light categories, you can go to domestic straight hair, do not need to vote overseas warehouse,

Early-stage capital requirements and stocking pressure are low.

How long does it take to do DTC?

After the initial “seed users,” the DTC brand begins with a large-scale repurchase.

However, according to different industry types and different vertical categories, the demand for seed users isalsodifferent.

Once the initial wave of seed users hits a threshold, DTC brand profitability will grow.

It takes a brand at least 2-3 years to gain its first seed users and establish a large-scale repurchase.

In recent years, especially after the wave of Amazon titles in 2021, many companies have begun to transform in the direction of SHEIN and Anker, or do some financing under the banner of SHEIN and Anker.

Judging from the status quo, there are many companies that may get capital money, but there are very few possibilities that can eventually form positive feedback on their DTC development after getting financing.

For DTC , capital has a very strong boost in nature . The core of DTC is to accumulate users , and for a brand-new DTC brand, the most difficult thing is the accumulation of the first wave of seed users.

At this moment, burning traffic introduced 90% of users. If the brand side has capital, it can speed this stage’s precipitation and leap.

And why do those brands with capital blessings stand out in the industry?

On the one hand, there is no deep cultivation on the supply chain side.

Like SHEINmore than ten years of deep cultivation in the supply chainAnker’s heavy investment in R&D is not something that any company can learn in a short period of time.

On the other hand, there is no branded way of operating.

SHEIN seized social traffic dividends, and Anker got domestic approval from Apple.

SHEIN and Anker have been systematically marketed from the outset, with offline pop-up stores, internet celebrity marketing, etc., which are fundamental to their standing today.

From the perspective of capital alone, including the station groups in previous years and various “DTCs” in recent years, there are probably only a few independent cross-border stations, which can make capital fall into the field many times.

Investor added, “Capital has been stringent with the angel round’s DTC project. No one may care about an idea project.”

Who is more likely to make DTC in the future?

We have broadened our vision to the entire “Made in China”.

If “deep supply chain cultivation + brand-like operation” are employed to assess “China’s future DTCs,” many brands have already crossed this threshold.

Taking the clothing field as an example, domestic products such as Anta and Li Ning.

On the one hand, it has a mature supply chain system that is not inferior to SHEIN; Brand Marketing Promotion not only accumulates a lot of practical experience, but also has a certain foundation for the overseas influence of the brand.

Perhaps it will be more difficult for brands such as Anta and Li Ning to face SHEIN to cut the cake of the fast fashion track. However, if it continues to dig deep on the sports shoes and clothing track to establish a competitive barrier, it is unknown to create another “SHEIN” in the vertical field.

For them, though, a more realistic question is: Is DTC really worth it?

From the perspective of front-end promotion costs alone, whether it is traditional social media channels or Internet celebrity resources, traffic costs are at a high level.

How much can these brands recover when relaunched? In addition, its understanding and exploration of DTC channels, the adaptation of products in different channels, and the optimization of consumer experience, how long does it take for this long series of complex processes to run through? These issues require careful consideration.

The industry is changing, and so is the market situation. Under the existing DTC paradigm, the brand’s tens of billions in market value will be hard to recreate.

The next mainstream trend is that more DTC brands relying on the advantages of vertical fields stand out, and such brands usually have an annual output of 1 billion to 5 billion to basically reach the ceiling.

But that doesn’t mean the end. If these brands can dig deep in the vertical fields that already have advantages, until they reach the global TOP level, they have the right to speak in the industry, and they have huge energy on the product side or the user side, and they can lead the market;